Tax Planning Services to

Optimise Your Finances

You Save, You Earn…

Tax saving is a complicated subject for most people, as they do not clearly understand that there are more layers to tax-saving than only the exemptions available on your investments. With the right knowledge, not only you will pay the correct tax on your investments, but also know how to tax proof the income and actually create an asset out of your tax saving.

First of all, consider your capital as a liquid asset that does a better job with continuous investments, rather than being stagnant in the bank. Tax saving is a thoroughly discussed subject in the Indian constitution as well, where the tax savings investments are protected under Section 80C. There are various other schemes and allowances mentioned, like:

- HRA,

- Home Loans,

- LTA,

- Section 80D,

- Reimbursements,

- National Pension Scheme (NPS)

- Interest on education loan (Section 80E)

- Rajiv Gandhi Equity Savings Scheme (Section 80CG)

- House rent allowance (Section 80GG)

- Medical treatment under Sec 80DDB.

- SukanyaSamariddhi account

- Children’s tuition fees

Additionally, some of the significant tax saving schemes and policies are discussed below in details: |

Health Insurance (Section 80D)

A certain amount of money paid as a health insurance premium is not tax-deductible. Paid on an annual basis, this premium can save you some more taxes if you are a senior citizen.

Expenses to treat the disabled

As a part of Section 80DD, if you can furnish a certificate of disability, then you are eligible for a deduction of Rs. 75000 for 40-80% disability and Rs. 125000 for more than 80% disability. These expenses should solely be for training, rehabilitation, or treating a disease.

Expenses for treating specific diseases

As a part of Section 80DDB, tax deductions of up to Rs. 40000 are applicable for the treatment of diseases like AIDS, Cancer, and Dementia. For senior citizens, this deduction increases to Rs. 1 lakh.

Income through NRE account interest

Non-resident Indians have their NRE accounts in India. For the amount in the savings accounts or fixed deposits, they earn interest, and this interest is non-taxable, also called tax-free income.

Wedding gifts

Under Section 56(2), all wedding gifts are non-taxable, no matter the size of the gift, received as cash, cheque, or kind.

HUF and additional income

If you have multiple income sources, you can open a separate HUF account for the secondary income and invest it under Section 80C to avail tax benefits on this income, apart from your primary salary.

Reducing taxable income

To reduce your taxable income, here are some important tips to follow.

- You can reduce your tax liability significantly by understanding the terms of every single expenditure and investment that you make.

- Never wait until the last minute to calculate your taxes. Start this practice right from April and use your monthly investments to reduce the risk.

- Never invest where you have to pay too much taxes on the returns. Always go for the tax-efficient investment avenues.

What is importance of Tax planning in India ?

Tax planning in India holds immense importance as it allows individuals and businesses to strategically manage their finances while minimizing their tax liabilities within the framework of the law. By taking advantage of various deductions, exemptions, and tax-saving investments provided under the Income Tax Act, taxpayers can optimize their financial resources, enhance cash flow, and ensure compliance with legal requirements. Effective tax planning not only facilitates the achievement of long-term financial goals, such as retirement planning and wealth accumulation, but also supports government initiatives aimed at promoting economic growth and financial inclusion. Moreover, tax planning empowers individuals with greater control over their financial affairs, enabling them to make informed decisions and secure their financial future while mitigating risks and maximizing opportunities for growth and prosperity.Type of taxes in India ?

In tax planning in India, various types of taxes are considered, including:Income Tax:

Income tax is levied on the income earned by individuals, Hindu Undivided Families (HUFs), companies, and other entities. Tax planning strategies aim to minimize taxable income through deductions, exemptions, and tax-saving investments.Capital Gains Tax:

Capital gains tax is imposed on the profits earned from the sale of capital assets such as stocks, real estate, and mutual funds. Tax planning involves strategies to optimize capital gains tax liability, including holding assets for the long term to qualify for lower tax rates or utilizing exemptions available under the Income Tax Act.Goods and Services Tax (GST):

GST is a value-added tax levied on the supply of goods and services. Tax planning strategies focus on minimizing GST liabilities through proper classification of transactions, availing of input tax credits, and complying with GST filing requirements.Corporate Tax:

Corporate tax is imposed on the profits earned by companies registered in India. Tax planning for corporations involves structuring business operations, utilizing tax incentives and exemptions, and optimizing tax deductions to minimize corporate tax liabilities.Securities Transaction Tax (STT):

STT is imposed on transactions involving the purchase or sale of securities such as stocks and derivatives. Tax planning strategies may include timing transactions to minimize STT liabilities or choosing investment avenues with lower tax implications.Customs Duty:

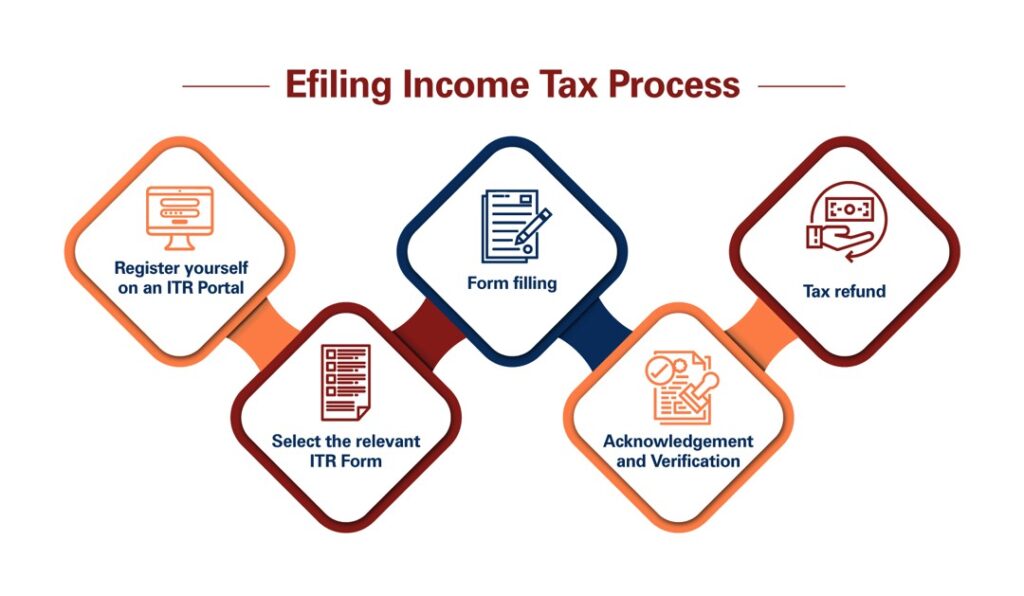

Customs duty is imposed on the import and export of goods. Tax planning strategies aim to optimize customs duty payments through duty drawback schemes, exemptions, and concessions available under international trade agreements.What are the steps involved in filing Income Tax Returns (ITR) in India?

1. Gather Documents:

Collect all necessary documents, including PAN card, Aadhaar card, bank statements, Form 16 (if salaried), details of income from other sources, investment proofs, and relevant tax-saving documents.2. Choose the Right ITR Form:

Select the appropriate ITR form based on your sources of income and filing status. Commonly used forms include ITR-1 (Sahaj) for individuals with income from salary, house property, and other sources, and ITR-2 for individuals and HUFs with income from capital gains or foreign assets.3. File Online or Offline:

You can file your ITR online through the Income Tax Department’s e-filing portal (https://www.incometaxindiaefiling.gov.in) or offline by submitting a physical copy of the filled ITR form at the designated income tax office.4. Register on the E-filing Portal:

If filing online, register on the Income Tax Department’s e-filing portal using your PAN card. If you are already registered, log in with your credentials.

5. Fill Out the ITR Form:

Fill out the ITR form accurately with details of your income, deductions, and taxes paid. Use the Form 16, Form 26AS, and other documents to ensure accuracy.

6. Verify Your Return:

After filing the ITR online, verify it using any of the available options such as Aadhaar OTP, net banking, or sending a signed physical copy (ITR-V) to the Centralized Processing Center (CPC) within 120 days of filing.

7. E-verify Your Return:

Alternatively, you can e-verify your return online using options such as Aadhaar OTP, net banking, bank account number, or Demat account number.

8. Acknowledgment:

Once the ITR is successfully verified, an acknowledgment receipt or an acknowledgment number is generated. Keep this for your records as proof of filing.

9. Monitor Processing:

Keep track of the status of your filed return on the e-filing portal. You can check the status of processing, refund status, and any notices issued by the Income Tax Department.

10. Respond to Notices:

If you receive any notices or communications from the Income Tax Department regarding your filed return, respond promptly with the required information or documents.

Search

Investment Plans

Insurance

Loans